In South Africa’s capital of Johannesburg, some of the most ubiquitous vehicles on the streets are the thousands of minibus taxis crammed tight with daily commuters traveling from the dusty townships into work. At the other end of the spectrum are souped-up sports cars and flashy convertibles zooming around the leafy suburbs that are home to the elite.

Increasingly, however, there’s another kind of vehicle cruising Johannesburg’s streets: new gas-powered SUVs with names like Chery, BAIC and Haval — all Chinese cars that industry experts say are giving more established brands a run for their money and gaining popularity with South Africans.

Potential car buyer Ross Grey was considering a large pick-up truck made by Chinese manufacturer JAC Motors.

“I’m a sales manager at a kitchen company, hence why I’m looking at buying a double cab, because I’ve got a young family and I need to also carry a lot of goods on the back of the vehicle, I’m often on building sites and that sort of thing,” he told VOA recently.

His interest in a Chinese-made vehicle stemmed in part from a bad experience.

“The Chinese vehicles are not on the stolen list like the big brands are,” said Grey, who was a loyal Toyota Hilux owner until car thieves stole his car. The Hilux is one of the most stolen cars in South Africa – often for its engine, which fits perfectly into commuter minibus taxis.

But, along with consumers, car thieves are now also taking notice of Chinese makes and models, data shows.

South Africans used to be skeptical about cars with the “made in China” label. While Grey acknowledged Chinese brands have not yet stood the test of time, he said his research shows the quality seems to have improved in recent years.

In the fast lane

The biggest draw for many Chinese car buyers, including Grey, is the cost.

“The reason I’m looking at something like this, the Chinese vehicles, is because first of all the price, it’s a lot cheaper than your big brands that have been in the country for many, many years,” he said.

Chinese-imported vehicles cost a lot less than most SUVs from Germany’s Volkswagen, America’s Ford or Japan’s Toyota, said Mikel Mabasa, CEO of South Africa’s car industry organization Naamsa.

“These Chinese brands have actually been growing at double digits, particularly in the last three years,” he told VOA. “So if you look at growth between 2019 and 2023, we’ve seen actually a more than 200% increase in terms of Chinese brands that are coming into the South African market, and that is obviously very, very unusual.”

Mabasa added: “But I think there are reasons … many of those brands, if you look at the price points, are much cheaper than competing brands.”

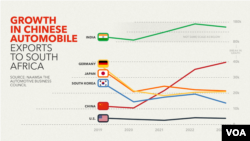

The number of imported Chinese vehicles in South Africa has steadily increased, with more than 39,000 automobiles brought into the country last year, compared with some 11,000 in 2019, according to Naamsa figures.

German imports showed the opposite trend, with just over 21,000 coming into the country in 2023, down from almost 37,000 in 2019. Vehicles imported from Japan show similar figures. The U.S. exported almost 4,200 vehicles in 2019 but close to 300 fewer automobiles last year, statistics show.

In terms of sales, certain models of established brands such as Ford and Toyota are still leading the pack, but Chinese upstarts are not far behind. Between July 2023 and July 2024, Chinese brand Chery sold more than 11,000 of their Tiggo 4 Pro models in South Africa. That’s compared with 25,000 Ford Rangers and 34,000 Toyota Hilux pickup trucks during the same period.

Going electric

South Africa is itself a major producer of cars, with manufacturing plants in the country for brands including Ford, Toyota, BMW, Mercedes, Nissan, Volkswagen and Suzuki.

“Thirty-nine percent of the components that they use in the manufacturing process are sourced locally in South Africa,” Mabasa told VOA. He said that while some of the cars made in South Africa go to the local market, more than 60% are exported overseas to nearly 150 countries.

The first local Chinese car manufacturing plant for BAIC was opened by Chinese President Xi Jinping and South African counterpart Cyril Ramaphosa in Eastern Cape province to great fanfare in 2018. The Chinese consulate in Cape Town described the project “as a milestone for the two countries’ economies.”

But the project hit some bumps in the road.

“They’re still in the setting up phase, they’ve obviously experienced some hiccups in getting that particular plant off the ground,” said Mabasa.

BAIC executives have told local South African media the pandemic and labor disputes were to blame for the delay. But Mabasa is still hopeful.

“We obviously wish them well, and I think it’s a model that a number of other plants or companies from China would definitely adopt as a template should they wish to come into South Africa and start manufacturing vehicles,” he said.

That’s something Ramaphosa is also encouraging. On a state visit to China last month, he visited the headquarters of massive Chinese electric vehicle maker BYD.

“We have introduced policies to promote the development of the electric vehicle industry in South Africa,” the South African president said on the trip.

“We are certain that companies such as BYD … will find South Africa a unique and advantageous location that can serve as a hub to reach other markets.”

The electric vehicle revolution is in the very nascent stages in South Africa, where gas is still king. However, BYD is looking to Africa as it faces increasing trade restrictions in the U.S. and Europe.

BYD already has a showroom in South Africa and recently opened others in Rwanda, Zambia and Kenya.