A winking owl greets drivers pulling in for petrol, snacks and drinks across Quebec — the logo of Alimentation Couche-Tard, which from a single outlet in 1980 has become a $53bn company with 16,700 owned or licensed convenience stores worldwide.

Couche-Tard, French for night owl, is now in pursuit of the world’s largest convenience store chain after swooping in with a rejected preliminary offer of $39bn for 7-Eleven owner Seven & i Holdings of Japan.

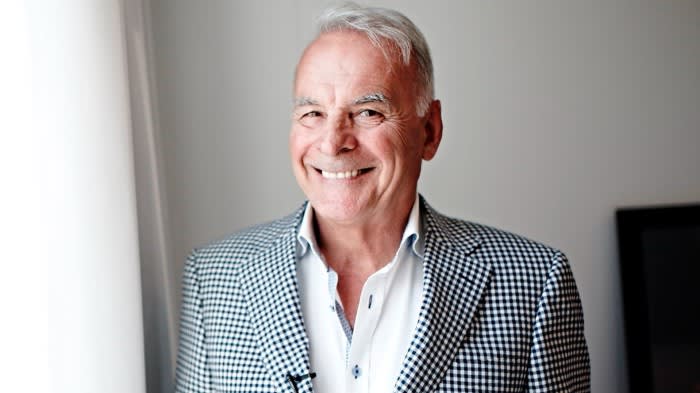

The driving force behind Couche-Tard’s strategy is Alain Bouchard, the man who opened the first store, according to industry executives, bankers and analysts.

Bouchard retired as chief executive of Couche-Tard a decade ago but people who know the 75-year-old, now executive chair, say he remains deeply involved in the business.

As Couche-Tard’s largest shareholder with a 12.9 per cent stake worth C$9.2bn (US$6.8bn), he is one of Canada’s richest people. Yet outside of Quebec province, where he lives and is a philanthropist with his wife, he is hardly known.

“What he’s done is incredible,” said Sylvain Charlebois, a management professor at Dalhousie University in Halifax. “He’s a victim of his own sector not being seen as a sexy one.”

Acquaintances describe Bouchard as modest and down to earth, the kind of executive who visits stores daily and picks up litter from the forecourt.

The billionaire had a financially precarious adolescence, according to his biographer Guy Gendron.

When he was 9, his father was forced to take work in the distant mines of Labrador after his company went bankrupt, and the family moved into a mobile home. Bouchard’s mother temporarily entered a psychiatric institution and his 12-year-old sister became the primary caregiver to him and their other four siblings.

“Bouchard, because of that, was looking for revenge on life,” Gendron told the Financial Times. “He’s a pathological entrepreneur.”

He opened his first store outside Montreal in 1980 and five years later bought 11 more around Quebec City that bore the name Couche-Tard, branding he retained. The company gobbled up more chains around Canada including Perrette, Provi-Soir and Mac’s.

Bouchard and his three founding partners moved into the US in the 2000s, doubling Couche-Tard’s footprint overnight with the purchase of Circle K’s 1,600 stores from ConocoPhillips for $830mn. All the company’s stores outside Quebec now carry a Circle K banner.

When Norway’s Statoil, now Equinor, sold the company its Scandinavian service stations in 2012, Couche-Tard gained a beachhead in Europe. A 2020 deal in Hong Kong and Macau expanded its presence into Asia.

Couche-Tard’s stores rang up $69bn in sales worldwide in its last fiscal year, with earnings before interest, tax, depreciation and amortisation of $5.6bn. Almost three-quarters of its stores were accumulated through mergers and acquisitions, chief financial officer Filipe Da Silva said in an investor presentation in late 2023.

The company is targeting $10bn in ebitda by 2028, of which $1.1bn should come from new M&A, according to its annual report. Centre stage will be the US.

The largest operator by far in the US is 7-Eleven, with more than 12,500 US stores to Circle K’s 7,100, according to Technomic. Seven & i rejected Couche-Tard’s offer this month as “grossly” undervaluing its business.

Bouchard is known for his dealmaking. “He would be involved at the highest level,” said Michael Van Aelst, a Montreal-based consumer staples analyst at TD Cowen.

Henry Armour, chief executive of the National Association of Convenience Stores, said that since Bouchard stepped down as CEO “it is my perspective that Alain has been a very hands-on executive chairman. I think he very much concentrated far less on operations and far more on acquisitions, real estate, really high-level strategy of the organisation”.

People who know and have done business with Bouchard say his approach to M&A has evolved.

The group has a long history of audacious unsolicited approaches, including failed moves in 2010 for Casey’s General Stores, the third-biggest US convenience store chain, and in 2021 for Carrefour in France — an effort that was abandoned after opposition from Paris.

“If you go back and look at his history over the last 20 years, he’s cheap,” said one senior businessman who has dealt with Bouchard. “And you have to give him credit for that . . . for trying to get the best assets he can as cheaply as he can.”

One fund manager who has followed the Seven & i offer said he could not believe Couche-Tard or Bouchard were prepared to walk away this time. “The opening offer from Couche-Tard was laughably low,” he said. “He must have known it would be rejected . . . You would bet it’s just a starting position.”

After Seven & i rejected its initial offer this month, Couche-Tard said it remained “highly focused” on pressing ahead with a friendly takeover.

Couche-Tard and Bouchard declined to comment. The company has previously said that combining with Seven & i would create a “leading global retail platform” with more than 100,000 sites spanning Asia, North America, Australia and Europe.

JPMorgan analysts estimate a combined entity — even if 10 per cent of shops were closed to clear competition concerns — would have a market share of 12.5 per cent in the US, “which would put it in a dominant position with seven times the number of stores” of Casey’s.

Analysts say that kind of opportunity, and the ability to curtail the risk of 7-Eleven becoming ever stronger in the US, is why Couche-Tard has been circling Seven & i since for years, making repeated overtures in the hopes of paving the way for a friendly deal.

“In the end perhaps this is a defensive bid,” said Michael Causton, co-founder of retail research agency JapanConsuming. “Because if Seven & i applies the logistics prowess and relentless product development schedules of its Japan business to the US . . . then it will hammer competitors, like Couche-Tard.”

Associates say Bouchard will not be rushed.

“The logo of Couche-Tard is a night owl with one eye closed and one open,” Gendron said. “It’s a symbol of the way the company operates: it’s patient like a night owl, waiting for prey.”