This article is an on-site version of our Moral Money newsletter. Premium subscribers can sign up here to get the newsletter delivered three times a week. Standard subscribers can upgrade to Premium here, or explore all FT newsletters.

Visit our Moral Money hub for all the latest ESG news, opinion and analysis from around the FT

Hello from Toronto, where I enjoyed taking part in a discussion yesterday at the UN-backed Principles for Responsible Investment’s annual conference with panellists including Canadian senator Rosa Galvez.

Galvez is behind one of the most interesting pieces of climate legislation currently in the works. Her proposed Climate-Aligned Finance Act would require Canadian financial institutions to align with national climate commitments, including the Paris Agreement, “as a superseding duty” under national law.

Galvez gave an uncompromising argument to the assembled asset managers of the need for legislative change to drive the energy transition, and the limits to what voluntary private-sector action can achieve.

“There is some leadership coming from the private sector,” she said. “But the elephant in the room is that you are all in competition. So we need somebody to come and give the rules.”

A similar message came yesterday from a group of investors focused on sustainability in the mining sector, as I highlight below. First, though, Patrick Temple-West and Camilla Hodgson have news on a new fundraising round by one of the most high-profile companies in the energy storage sector: an industry that will need to play a vital role as electricity grids shift towards intermittent solar and wind power. — Simon Mundy

energy storage

Exclusive: Form Energy raises $405mn in latest round

Form Energy, a leader in the emerging rust-to-energy batteries business, has raised $405mn in its latest funding round, the company is set to announce today, marking yet another sign of booming demand for electricity storage.

While most battery producers use lithium to store energy, Form stands out among its competitors with its process that combines iron and oxygen to make rust. The reversible rusting process can be used to store and discharge up to 100 hours of battery power, Form claims.

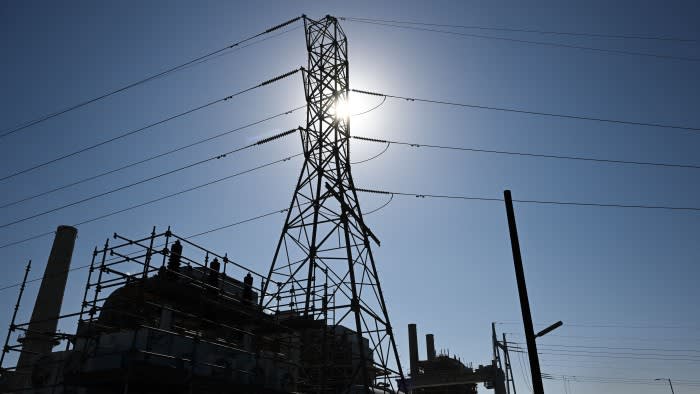

These types of iron-air batteries are too heavy to work in electronics, but they are well suited for storing power in an electricity grid — which is increasingly necessary to allow the transition from fossil fuel-based power generation to renewable energy. That’s because renewable sources such as wind and solar are variable, and without storage for the grid it’s impossible to call on solar power when the sun isn’t shining or wind power when there’s no breeze.

Form’s latest haul is slightly smaller than the $450mn the company raised in 2022. But the deal includes new investors T Rowe Price and GE Vernova, two companies that want to see evidence of a sturdy business — rather than unproven ideas — before plopping down cash. TPG’s Rise Climate fund made its initial investment in Form in 2021, and the private equity firm’s partner Marc Mezvinsky remains on Form’s board of directors.

Form’s fundraising underscores demand for electricity storage. California and other states are working with utilities to install long-duration battery storage in electricity grids.

In addition to facilitating the energy transition, increased storage could ease pressure on the grid as demand for electricity continues to grow. And it wasn’t all driven by artificial intelligence, said Mateo Jaramillo, a former Tesla executive who co-founded Form Energy in 2017. Manufacturing and continued demand for electric vehicles were also straining electricity grids, he said.

Perhaps the biggest sign of fresh electricity demand was Microsoft’s deal in September to reopen the Three Mile Island nuclear power plant, which was the site of the worst nuclear accident in US history. Analysts at Wolfe Research estimated the Microsoft power purchase agreement was up to $110 per megawatt hour, significantly more than the typical price of about $60 seen in recent deals.

“It means I can probably raise my prices,” Jaramillo said. “Now, everybody is probably thinking that. But from our perspective, we had been making very conservative assumptions about what our pricing needed to be in the market. And in the [Microsoft] case, what it is showing is that probably, we don’t need to be quite as conservative at least on the margin here.” (Patrick Temple-West and Camilla Hodgson).

responsible investing

Mining-focused investors set out their objectives

Five years ago, a tailings dam at an iron ore mine near Brumadinho in south-eastern Brazil collapsed, unleashing a vast mudflow that killed 270 people. The disaster galvanised discussion among institutional investors on the need for higher standards in the mining sector, leading to the launch last year of a new initiative, the Global Investor Commission on Mining 2030.

A new report from the commission, published yesterday, gives a sense of the central objectives for these investors, which include pension giants such as the Netherlands’ APG, Canada’s CDPQ, California’s Calstrs and the UK’s USS, as well as asset managers such as Abrdn and Ninety One.

The group now plans to focus on developing a clear set of common standards that investors will expect from mining companies, intended to set a new benchmark for good practice across the industry. Other focus areas include tackling the risk of mining feeding into conflict, and managing the specific social impacts around mine closures — a particular challenge in the coal industry, where a successful energy transition will require a shortened lifespan for many mines.

The report puts heavy emphasis on the need for public policy and regulation to lead the way in raising standards in the industry, and pledges new efforts by investors to engage with governments. “There is no real substitute for the state’s power to set comprehensive standards and hold companies to account if they fall short,” the report says. (Simon Mundy)

Smart read

-

Bosses of leading financial institutions, including BlackRock and Standard Chartered, are set to stay away from this year’s COP29 climate summit in Azerbaijan.

-

Governments need a renewed focus on electric grid investment as the transition to renewable energy gathers pace, warns the FT editorial board.

Recommended newsletters for you

FT Asset Management — The inside story on the movers and shakers behind a multitrillion-dollar industry. Sign up here

Energy Source — Essential energy news, analysis and insider intelligence. Sign up here