Ola Källenius is betting $45 billion that Mercedes-Benz will own the future of luxury electric cars.

That’s how much he’s investing to shift all of the brand’s powertrains to electric by 2030.

On the one hand, Mercedes has to bet big on EVs. So must every major automaker as governments around the world — in Europe, the United States and China — seek to dramatically cut back on the greenhouse gases and other air pollutants that their products have been spewing for more than a century. Elon Musk and Tesla set an example that regulators could point to: It’s possible to build electric cars that people want to buy.

On the other hand, as the entire automobile industry undergoes the biggest transformation since its beginnings, Källenius sees a massive opportunity for the Stuttgart, Germany, company, which sells 2.4 million cars and vans worldwide, to make an aggressive move.

Since the early 20th century, the brand has been synonymous with sleek design, Källenius said, gliding into marketing mode. Inside a Mercedes, which can range in price from just over $50,000 to near $200,000, you almost feel like you’re at Tiffany’s: “When people see an air vent, we see a piece of jewelry,” he said. (Clark Gable, Princess Diana and Germany’s former Chancellor Konrad Adenauer, among others, were fans, he noted.)

In other words, when you think Mercedes, Mercedes would like you to think glamour.

And right now, the glamour market for EVs is up for grabs. Mercedes’ share of the U.S. luxury-car category has dipped in recent years, from about 17% in 2018 to about 13% last year, said Jessica Caldwell, market analyst at Edmunds. Much of that was given up to Tesla.

But Tesla has just about given up on the upper crust of the luxury market. Customer interest in Tesla’s high-priced Model S and Model X cars is in rapid decline, while prices of the Model 3 and Model Y continue to fall, and the company is talking about building low-price cars in India. With its S series, that category is Mercedes’ bread and butter.

But to take the spot of undisputed leader in luxury EVs, Mercedes has to nail both form and function — an increasingly complicated and expensive endeavor with the industry’s headlong push into autonomous driving. Plus, it must fend off tough competition from the likes of traditional luxury car makers BMW, Audi and Cadillac, and from EV upstarts such as Polestar, Lucid and Rivian, as well as new brands in China.

Källenius, a 54-year-old native Swede who visited the San Francisco Bay Area in late June to inspect Mercedes’ Silicon Valley research and development center, believes the company is up to the challenge.

“We’ve always been a leader in innovation and technology, and in timeless luxury, luxury in its time,” he said. “What will be Mercedes’ quest now going into the electrical era and the digital era is to deliver again on those two.”

Leveling up self-driving expectations

Mercedes opened its Sunnyvale R&D center in 1994. Although the company has researchers spread around the globe, California remains the hub for its most cutting-edge tech development, especially in software, AI and autonomous driving. Källenius was in town for a firsthand look at how its driverless car technology is progressing.

Mercedes became the first automaker approved for Level 3 autonomous driving in the United States on June 8, when the California Department of Motor Vehicles issued the company a required permit.

What’s Level 3? Basically a car that truly drives itself in dense highway traffic, allowing you to talk on the phone, read, watch a movie, arrange a Tinder date, use the mirror to yank that errant nose hair from your nostril — as long as you’re ready to take over and pull the car to the side of the road in case the system encounters something it can’t handle.

You may think, based on marketing claims, that Tesla’s so-called Full Self-Driving feature allows that. But it doesn’t. Despite its name, Full Self-Driving is a Level 2 technology that legally requires a human driver’s full attention. (The California Department of Motor Vehicles is investigating whether Tesla’s Full Self-Driving claim constitutes marketing fraud.)

Mercedes’ Level 3 feature, if it works as advertised, will put the company ahead of Tesla with a true autonomous vehicle.

Unlike Tesla, whose Full Self-Driving by far tops the list of automated vehicle crashes logged by federal safety regulators, Mercedes is taking more gradual steps to full autonomy.

Mercedes’ Level 3, available in the U.S. late this year as an option on model year 2024 Mercedes‑Benz S-Class and EQS sedans, will allow a car to fully drive itself, but only on mapped sections of specific highways and, for now, only up to speeds of 40 mph. That limit means the system will be used mainly in heavy, slow-moving traffic, which many find the lowest and most tedious form of driving anyway.

The company is so confident in the technology that it has said the manufacturer, not the driver, takes on the liability if there’s a crash, as long as the system was operated properly. “During the period it is in Level 3, it is the computer driving and not the human,” Källenius said. “That’s as clear a line as you can get. It is the computer and it is us who [are] responsible for what’s happening. If you misuse it to do something you’re not supposed to do that’s a different matter. But for all intents and purposes, the liability sits with the product.”

Although he declined to talk about any other company’s approach to self-driving liability, the subtext was clear: Tesla defends itself against lawsuits that result from Full Self-Driving crashes by saying the human driver is at fault, not Tesla’s technology.

Karl Brauer, auto industry analyst at online vehicle search and research site iSeeCars.com, calls Level 3 not just a “game changer” but the start of “a sea change in human culture.” Other companies will be introducing Level 3 over the next several years. But if Mercedes can maintain its lead, “you can’t overstate how much an advantage it’s going to be for them,” Brauer said.

Owners of Level 3 cars will increasingly “get back the most valuable gift of all — time,” Källenius said. And Mercedes wants to be at the forefront.

The company is redesigning the interior of Mercedes-Benz cars into a combination home theater and home office, with a “hyperscreen” that covers the dashboard nearly door to door, and, of course, a top-end sound system. The faster Mercedes moves toward truly autonomous driving, the more it plans to profit from content that flows into and out of the cloud-connected vehicle, including subscription fees and a share of advertising revenue.

Hyperscreen in Mercedes-Benz EQS

(Mercedes-Benz)

Anyone who’s purchased a car in recent years knows that the computer systems inside cars are a work in progress, with voice recognition especially problematic. Some, such as Volvo and Polestar, have turned to Google to provide the underlying computer operating system. Unlike most other car companies, Mercedes years ago began building its own basic operating system, called MB.OS, with a software platform other parties can tap into once revenue-sharing details are worked out. It’s been incrementally rolling out the software over the last few model years.

More recently, Mercedes teamed up with OpenAI to add ChatGPT, the machine intelligence application, to selected vehicles as a beta test. The goal is to help the car computer figure out what drivers want when they speak commands, and hold some (for now) simple conversations with them.

Rethinking how to deliver more power

The research and development isn’t all digital. “This is still a physical product,” Källenius said. Electric motors are a commodity product, first invented in the 19th century. But electric vehicles are creating new opportunities for electric motor innovation — especially for high-priced vehicles.

Electric cars, unlike internal combustion vehicles, deliver a lot of instant torque — meaning, they can blast off from a standing stop with high speed and greater G-force that knocks riders back in their seats.

That torque can be adjusted through hardware and software, though. “You can map that out in a way to give you whiplash, send you to your chiropractor,” Källenius said. He didn’t mention Tesla, but that instant torque is one of the selling points at Elon Musk’s company. Mercedes, he said, geared its torque so that it’s powerful, but also smooth.

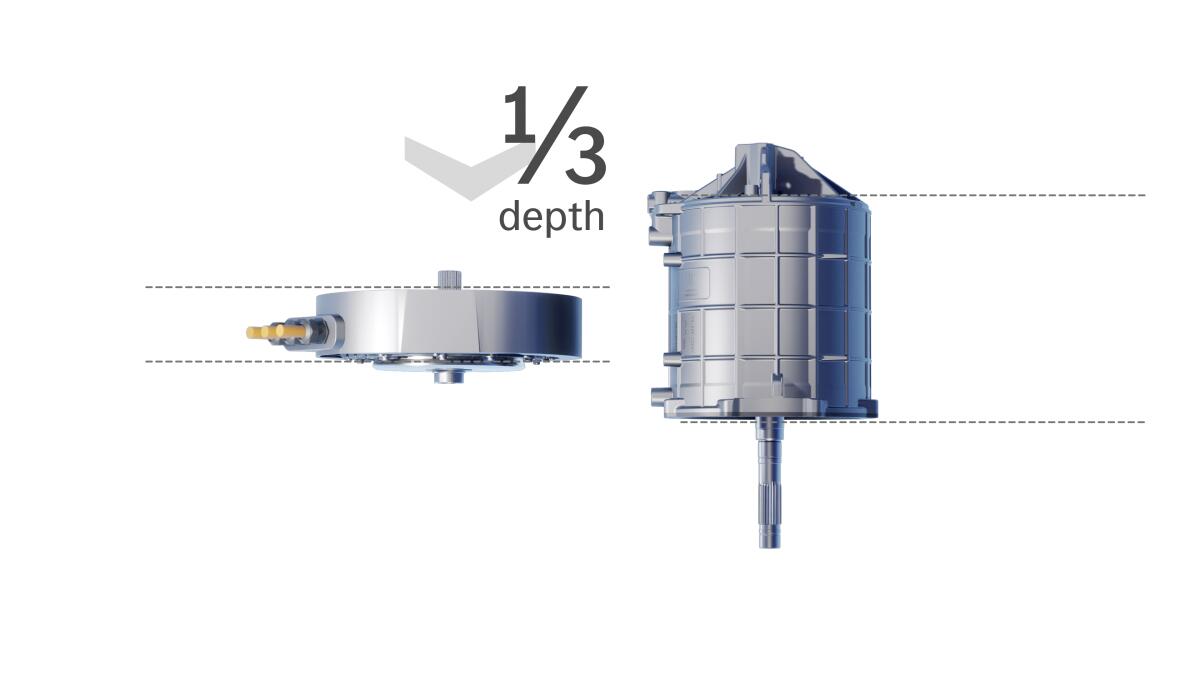

Mercedes buyers who make lusty power and responsive handling their top priorities have always favored the company’s AMG performance line. The next electric AMG line, whose release date is still undetermined, will use a new kind of electric motor called “axial flux.” Picture a traditional motor as a loaf of bread, and an axial flux motor as a thick pancake. It’s far more efficient, delivering more power even though it’s smaller and takes up less space. It’s expensive, though, and so far has been installed only on supercars that cost hundreds of thousands of dollars.

Mercedes-Benz axial flux electric motor and regular motor.

(Mercedes-Benz)

Less weight means more range. Smaller dimensions means more design flexibility for mechanics and passenger comfort. More power means more power.

The axial flux was developed by researchers at Oxford University who started a company called Yasa Motors. Mercedes bought Yasa Motors in 2021 and is helping it build manufacturing lines that can amp up production volume and bring costs down.

“We are reinventing the original investments of our founding fathers, and investing billions and billions into these new technologies,” Källenius said.

It’s an expensive strategy to try to shift Mercedes to the cutting edge of the electrical-digital auto industry revolution. If it works, it could signal where the technology is heading in more affordable cars in the not-too-distant future.

Auto analyst Brauer is confident the company has the engineering chops to take the innovative lead in electric vehicles: “I don’t question that Mercedes-Benz will have the most impressive execution of electric vehicles.”

But he warns that success “isn’t necessarily a question of capability.” Electric cars remain more expensive than gasoline and diesel cars, but with smaller profit margins for automakers that will delay return on investment. Public charging remains a time-consuming hassle. China controls most of the minerals required to manufacture EV motors and batteries. Mineral costs are unpredictable.

So is consumer acceptance. EV sales are rising, but it’s unclear when they might plateau. Governments are mandating that car companies build electric vehicles. But no one mandates that customers must buy them.

Watch L.A. Times Today at 7 p.m. on Spectrum News 1 on Channel 1 or live stream on the Spectrum News App. Palos Verdes Peninsula and Orange County viewers can watch on Cox Systems on channel 99.