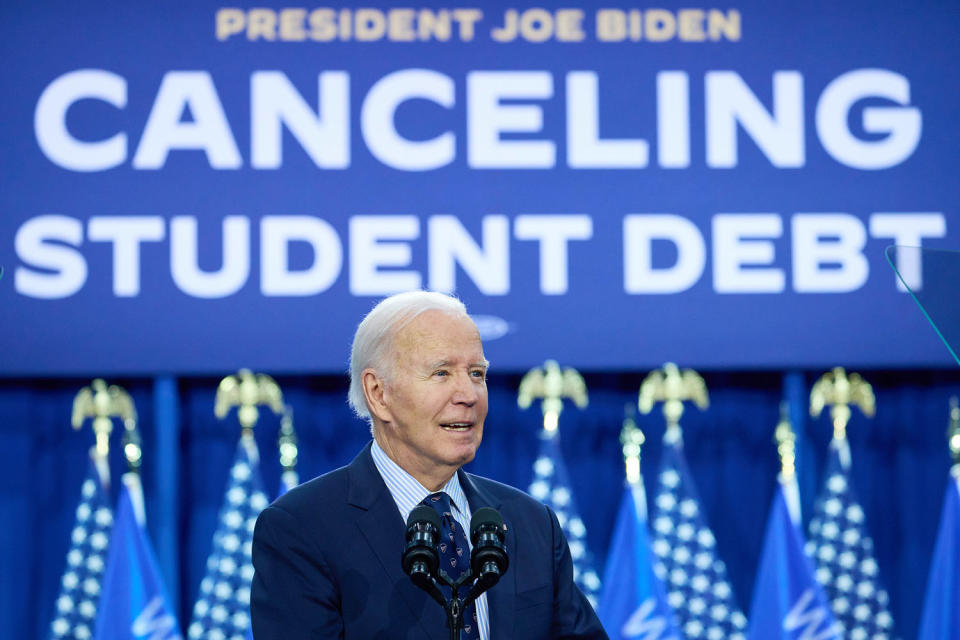

WASHINGTON — The Supreme Court on Wednesday rebuffed a Biden administration plea seeking to revive the latest plan to tackle federal student loan debt.

The court in a brief order denied an emergency request filed by the administration seeking to lift a nationwide injunction imposed by an appeals court. There were no noted dissents.

The order said the appeals court that is currently handling the case should “render its decision with appropriate dispatch.”

The Education Department issued a regulation finalizing its Saving on a Valuable Education, or SAVE, plan in July 2023, the month after the Supreme Court ruled the administration lacked authority to implement President Joe Biden’s earlier loan forgiveness program.

The new effort, like the previous one, was challenged by multiple conservative-leaning states led by Missouri.

“This court order is a stark reminder to the Biden-Harris administration that Congress did not grant them the authority to saddle working Americans with $500 billion in someone else’s Ivy League debt,” Missouri Attorney General Andrew Bailey said in a statement. “This is a huge win for every American who still believes in paying their own way.”

The Education Department did not immediately return a request for comment.

The new proposal has several provisions, including one that would cap the amount people have to repay for undergraduate loans at 5% of their incomes. Previously the cap was 10%.

Challengers said it would require spending up to $475 billion that was not authorized by Congress. They say it should be blocked for the same reason that the Supreme Court blocked Biden’s earlier plan.

Under the “major questions” doctrine embraced by the court’s conservative justices, federal agencies cannot initiate sweeping new policies that have significant economic effects without having express authorization from Congress.

The states argued in court papers that the Biden administration’s “assertion of unfettered authority to cancel every penny of every loan is staggering.”

Other provisions in the new plan would place limits on accrued interest and shorten the payment period for certain small loans, allowing them to then be forgiven.

The states sued in April seeking to block the plan, with a federal judge in Missouri finding only that the shortened repayment proposal should be put on hold.

But in an Aug. 9 decision, the St.Louis-based 8th U.S. Circuit Court of Appeals issued a more sweeping injunction putting other provisions on hold.

In court papers, Solicitor General Elizabeth Prelogar said the changes to repayment amounts are allowed under a 1993 federal law, which says the Education Department can determine the “appropriate portion” of income to calculate payment amounts and to set repayment timelines.

She said the “vastly overbroad” appeals court injunction goes beyond the new plan and blocks implementation of previous changes to repayment terms dating back to 1994, thereby “disrupting the settled expectations of borrowers who have made payments for years or even decades.”

Around 8 million people are already enrolled in the SAVE plan, with other provisions previously in effect that have allowed for repayment amounts to be reduced.

The plan has also been challenged in other courts, with judges blocking parts of it. But the 8th Circuit’s decision has made those cases less relevant.

For that reason, the Supreme Court on Wednesday rejected a separate application brought by a different group of states challenging the plan.

This article was originally published on NBCNews.com