Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Tiffany & Co is ready to talk time once more — by repositioning its watchmaking proposition towards the higher end of the market and aligning it with the brand’s established jewellery designs.

Four years after it was acquired by French luxury giant LVMH, the 188-year-old American business is exhibiting five new high-end models and showcasing pieces from the four jewellery watch collections that it has slid out since late 2021: Eternity Round; Eternity Cushion; HardWear; and Jean Schlumberger by Tiffany.

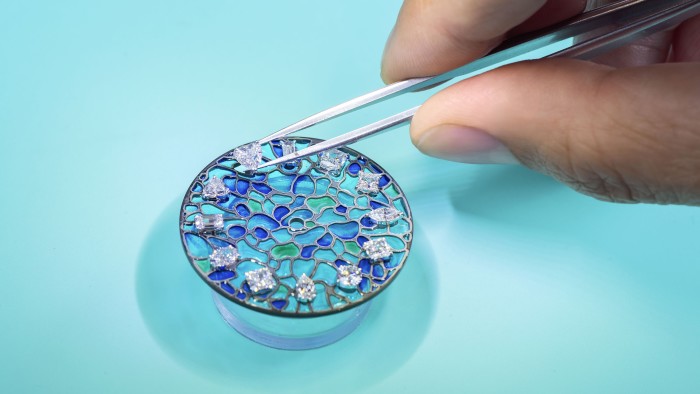

Tiffany launched its first Schlumberger-themed watches in 2023, each based on the designer’s best-selling Bird on a Rock and Fish brooches. These 36mm and 39mm high-end, high-priced women’s pieces are variously decorated with diamonds, coloured stones and enamelling, and demonstrate the direction in which Tiffany’s watch offering is decisively heading.

“When I arrived, I was surprised to see that Tiffany had never previously taken a manufacturing approach that placed its watchmaking side by side with its jewellery activity,” says Nicolas Beau, who joined the brand as vice-president of horology in 2021. He had spent the previous 14 years with Chanel, during which time he helped to establish the ceramic-cased J12 range as one of the great watchmaking success stories of the 21st century.

“What we are doing now is merging the two together, making watches based on jewellery, rather than based on the watch market.”

More than 95 per cent of Tiffany’s revenues come from jewellery sales and chief executive Anthony Ledru wants all its watch launches from now on to be “100 per cent linked to our jewellery activity”. “We want people to look at these watches as Tiffany clients who know about Tiffany jewellery and instantly to see the bridge between the two,” he says.

Jean Schlumberger by Tiffany Bird on a Rock

The Tiffany Carat 128 Aquamarine is inspired by the 128.54 carat yellow Tiffany Diamond

Ledru says the horology side of the business has enjoyed double-digit growth each year since LVMH’s $15.8bn acquisition, largely as a result of the average watch price being three times higher than that of the average jewellery price.

That means the expected median watch price during 2025 will be around $25,000, with the most expensive piece being the just-launched $590,000 aquamarine version of the Carat 128 watch inspired by the famous 128.54 carat yellow Tiffany Diamond.

All such gem-set watches use stones sourced from Tiffany New York and are created, developed and assembled at the Geneva premises into which the brand moved its horological operations in 2023. The location puts it in easy reach of movement manufacturers such as LTM (Le Temps Manufactures), which supplies the animated mechanism used in the Bird on a Rock watches, and LVMH-owned Zenith, which Tiffany turned to last year to supply movements for a moon-phase model.

For the SFr275,000 ($305,000), 25-piece Bird on a Flying Tourbillon watch from the Schlumberger collection, however, Tiffany commissioned a 205-part bespoke movement from specialist Artime.

Ledru says discussions about reviving Tiffany’s watch operation only started materialising over the past couple of years, having first focused on other priorities after LVMH’s acquisition — such as the revamp of the brand’s flagship Manhattan store, which reopened in 2023. “We needed to wait a bit more to have a sense of readiness and to have a collection with coherence instead of just a few new products,” he says.

Anthony Ledru, Tiffany’s CEO

Nicolas Beau, Tiffany’s vice-president of horology

Ledru’s caution is understandable, given that Tiffany’s last two attempts at a watchmaking reboot — both of which occurred well before the LVMH acquisition — ended in failure. In 2007, the jeweller entered a contract allowing Swatch Group to make and sell watches under the Tiffany brand name, but the deal turned sour when Swatch claimed Tiffany blocked development of the partnership. The spat led to a four-year legal battle, with the case being set aside in 2015.

Tiffany attempted its own horological relaunch that same year, with a range of models produced at a plant in Chiasso on the Swiss-Italian border. These were based on vintage pieces from an era when the jeweller’s watches carried considerable prestige. Versions of some of those — such as the CT60, Union Square and Atlas — remain in the collection but, according to Ledru, are being phased out.

The brand is not, however, shying away from certain aspects of its past, as evinced by its record purchase of a gold Tiffany pocket watch gifted to Sir Arthur Rostron, captain of RMS Carpathia that rescued 700 passengers following the sinking of RMS Titanic in April 1912.

Tiffany paid $1.97mn for the piece at an auction held in November by specialist UK house Henry Aldridge & Son — making it the most expensive item of Titanic memorabilia ever sold. The watch was given to Rostron by the widow of Titanic’s wealthiest passenger, John Jacob Astor, and the widows of two other businessmen lost in the disaster that claimed 1,517 lives.

“Even if we were not in the watch business, we would have bought that amazing piece,” says Ledru — adding that, while Rostron was British, his actions in diverting the Carpathia’s course to go to Titanic’s aid represented “the American spirit of courage”.

The non-working watch, which was acquired with two missing hands that have now been replaced, has been added to Tiffany’s extensive horological archive of pocket and wristwatches. Ledru says the archive will serve as an essential element in Tiffany’s return to watchmaking success, because it confirms the brand’s heritage in the business.

“The watch business at Tiffany was a sleeping beauty — a bit like the whole brand,” he says.