Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

When Toyota announced last year it was expanding its battery plant in Greensboro, North Carolina, the Japanese carmaker hailed the $8bn investment as a sign it was in the electric-vehicle business in the US for the long term.

The facility, which will cost a total of $13.9bn once it is completed next year, is the company’s first dedicated battery plant in North America and will initially employ 3,000 local workers — with plans to expand that to more than 5,000.

But November’s election of Donald Trump, who has criticised electric vehicles and threatened to scrap a tax credit for them enacted by President Joe Biden, has forced Toyota and other auto manufacturers to make a difficult decision: double down, or downsize their US operations.

The Toyota plant is the single largest commitment to electric vehicles by a foreign auto manufacturer in US history. Battery production for hybrid vehicles is slated to begin in the first quarter of 2025, and batteries for EVs will enter production before the end of the year. Batteries for plug-in hybrids are due in 2026 and beyond.

Overall, the facility is designed to have 14 production lines. But “if customers decide we want more . . . we may need to consider building more”, says Sean Suggs, president of Toyota Battery Manufacturing North Carolina.

The North Carolina plant is central to Toyota’s electrification strategy. Toyota and its luxury Lexus brand hold a nearly 60 per cent market share for hybrids in the US. But it has been slow to adopt EVs, which are critical for meeting US environmental regulations that will come in over the next decade.

Now, the automaker has plans to launch up to seven EV models in the US over the next two years. In 2026, it will also start producing EVs for the first time in the US, at a plant in Kentucky.

Toyota’s investment spree is driven largely by Biden’s Inflation Reduction Act, passed in 2022, which provides sizeable tax breaks and incentives for “clean tech” industries. Toyota has received more subsidies under the IRA than any other company.

Trump’s return to the White House, though, has put those incentives in doubt. Even with the Biden-era incentives, which give consumers up to $7,500 in tax credits to buy a new EV made in North America, EVs still make up less than 10 per cent of new vehicle sales in the US. An end to the tax credit “could further squeeze EV sales in the US, which are already slowing”, says Hideaki Osawa at Mizuho Bank.

But the politics of EV tax incentives are not clear cut. Nine of the 10 states that have benefited most from the IRA are heavily Republican, and Trump has vowed to continue supporting manufacturing jobs even if he ends the EV subsidies. Investment in batteries and related fields could still slow, however, if he rolls back environmental policies, squeezing demand for EVs and renewable energy.

Suggs says that Toyota will continue its electrification push during Trump’s second term. The automaker’s aim is to tap demand in both hybrids and EVs through its battery-related investment.

Toyota’s decision to build in North Carolina came after the state spent years courting investment from Japan, which has long been the largest source for foreign direct investment in the US. Investment from Japanese companies last year totalled $783.2bn, putting it at the top of the list for the fifth consecutive year.

The state-backed Economic Development Partnership of North Carolina set up an office in Japan about a decade ago to connect with businesses there. Japanese companies have made “durable, long-term investments” in North Carolina in recent years, said Christopher Chung, chief executive of the organisation.

“Companies wouldn’t be making them if they thought there was even some potential risk out there that politics could get in the way,” Chung added.

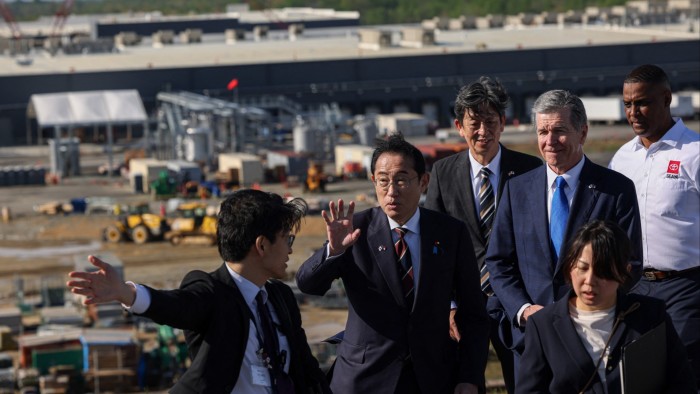

More than 200 Japanese companies now employ over 30,000 workers in North Carolina. Fujifilm said earlier this year it would invest $1.2bn in the state, with an eye on bolstering pharmaceutical supply chains in the US. Fujifilm director Toshihisa Iida cited support from the North Carolinian government and the state’s strong workforce when announcing the investment. Then-Japanese Prime Minister Fumio Kishida visited the state in April.

Despite the public reassurances, however, many executives remain concerned — though the investment decisions would be difficult to reverse.

“We have a number of factories under construction and, considering the costs involved with changing locations and reviewing supply chains, it is difficult to imagine halting investments,” says an executive at a major Japanese energy company.

In addition, even if Trump were to pare back subsidies, Japanese companies would continue to benefit from a bipartisan effort to break free from a China-centred supply chain — especially for EVs and batteries.

“The relationship between the United States and Japan will remain strong regardless of the outcomes of the elections in Japan or the United States,” says Roy Cooper, governor of North Carolina.